CPA Australia’s latest data reveals a widening gap between digital leaders and laggards, and outlines what SMEs can do about it.

Quick Snapshot

If you only have two minutes, here’s what you need to know:

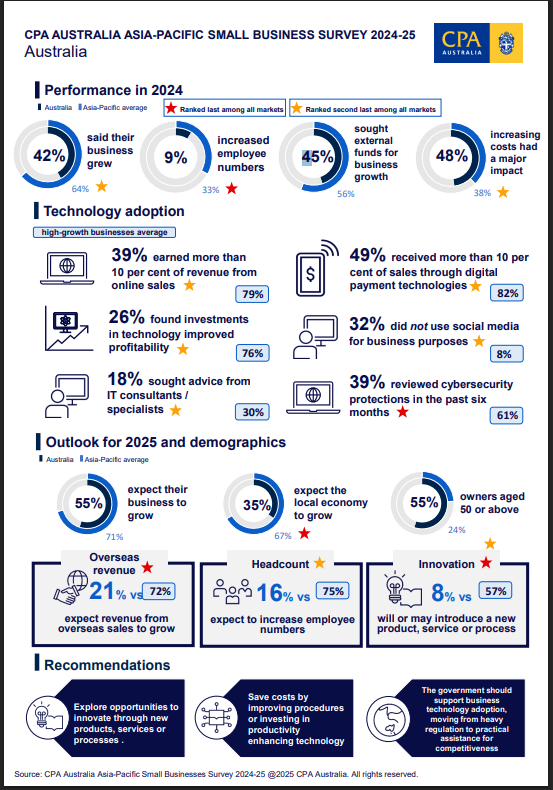

- Only 42% of Australian SMEs grew in 2024 — well below the Asia-Pacific average of 64%.

- While 74% Asia Pacific businesses plan to expand headcount in 2025, only 16% of Australian businesses will.

- Just 39% earn more than 10% of their revenue online.

- Growth expectations for 2025 rise slightly to 55%, but remain below those of regional peers.

- Young leaders (under 40) and firms with 5–19 employees are the most likely to grow.

- Businesses that invest in strategy, digital presence, and funding for innovation outperform others.

Bottom line: SMEs that lead with a clear strategy and digital capability will dominate 2025. The rest will struggle for visibility in an AI-driven marketplace.

The State of Australian SMEs in 2025

The CPA Australia 2024-25 Asia-Pacific Small Business Survey paints a clear picture: many Australian small businesses are cautious, even as opportunity expands globally.

While regional peers accelerate digital transformation, Australian SMEs risk being left behind due to slower adoption of e-commerce, underinvestment in marketing technology, and hesitation around growth funding.

Table of Contents

At netStripes, we see this not as bad news, but as a wake-up call. It highlights exactly where strategic and digital innovation can make the biggest difference.

1. The Growth Gap

- Only 42% of SMEs reported growth in 2024 versus 64% regionally.

- Only 16% expected to hire vs 74%

- Just 55% expect growth in 2025.

- The top performers share common traits — they plan, measure, and act on digital opportunities.

Pro Tip: Review your 2024 metrics. If your revenue hasn’t grown by at least 10%, treat 2025 as your digital transformation year. Set tangible quarterly targets for leads, conversion, and online revenue.

2. The Digital Opportunity

Only 39% of Australian SMEs earn more than 10% of their revenue online. In contrast, in Singapore and mainland China, the majority exceed that benchmark.

Digital revenue is no longer just an extra stream — it’s the foundation of competitiveness. SMEs with high-conversion websites, clear strategy, and strong digital marketing outperform in visibility, trust, and sales conversion.

Pro Tip: Aim for 20–30% of total revenue to come from online channels by the end of 2025. Start with a website conversion audit and a strategic content plan aligned to your buyer’s journey.

3. Marketing and Technology Investment: Mind the ROI

Australian SMEs acknowledge the value of Marketing and technology, but fewer see real returns. This suggests many are investing without clear alignment to business outcomes.

At netStripes, we find that ROI comes when:

- Tech and marketing investment is tied to clear goals.

- Owners and Teams have a clear road map/ strategy and are trained to use the tools that deliver.

- Results are about a best practice process, takes multiple skill sets and a patient data-driven approach until lead flow is established for each business.

- Establishing lead flow is about problem-solving until achievement, and it differs for every business.

- Data is reviewed regularly and acted upon.

Pro Tip: Don’t simply chase leads or silver bullets — establish best practice marketing processes, analysis of data, and a team that problem-solves until consistent repeatable lead flow is established. Patience is key.

4. Business Demographics and Growth Potential

CPA Australia’s data shows:

- Younger leaders (under 40) and businesses aged 5–10 years are more likely to grow.

- Firms with 5–19 employees perform best, balancing agility with resources.

This isn’t just demographic luck, it’s a mindset. These businesses are typically proactive, data-driven, and growth-oriented.

Pro Tip: No matter your age or business stage, you can emulate this mindset by setting measurable growth goals, adopting a learning culture, and reviewing strategy quarterly.

5. Access to Finance: The Growth Enabler

Businesses that grow are twice as likely to use external finance to fund innovation, marketing, and technology. This suggests that leveraging finance strategically rather than avoiding it, can accelerate growth.

Pro Tip: Prepare a Growth Funding Blueprint before approaching lenders. Detail how funding will generate returns — through business assets, digital marketing, automation, or website redevelopment.

Conclusion: 2026 The Year to Lead, Not Lag

The CPA Australia data shows a clear truth: growth is no longer a function of size, but of strategy.

SMEs that align their business goals with a powerful online presence, a data-driven marketing plan, and the right technology will lead their industries.

At netStripes, we’ve seen it time and again — when small businesses adopt clarity, strategy, and innovation, they don’t just grow; they transform.

2026 is your year to lead. Take charge with a strategy that’s grounded in data and executed with purpose. Because business leadership today begins and scales online.

source: www.cpaaustralia.com.au