Nearly 99% of businesses in Australia will be able to instantly write-off work assets as part of a much-needed measure to stimulate the economy. Big news for small and medium business owners! The Federal Budget announced by Treasurer Josh Frydenberg, contains several measures that will offer urgent relief to struggling small and medium businesses. The […]

Government initiatives to support businesses during Covid-19

With the Covid-19 pandemic battering the global economy, the Government’s decision to provide financial assistance through a stimulus package and grants is a wave of relief among small and medium sized business owners, but how do they actually work for us? Financial stimulus package The stimulus package includes payroll tax changes, a tax-free increase from […]

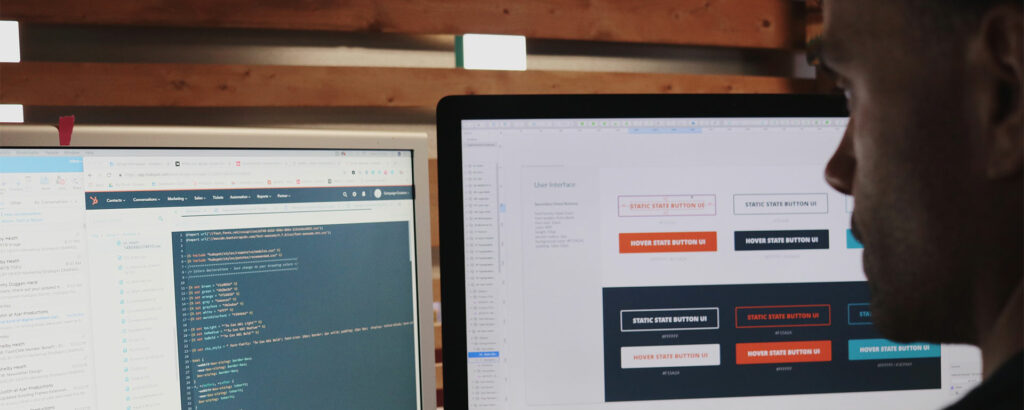

Why you should invest in online infrastructure with the instant asset write off

In a perfect world, we would all have infinite resources to spend on our businesses to boost sales. However, for most small businesses resources are scarce and what is available must be managed carefully. That’s why the instant asset write off is so important. It can be applied on assets such as digital solutions, software […]

Are you eligible for the $30,000 instant asset write off?

Ever since the announcement of an increase to the instant asset write-off, small business owners around Australia have been celebrating the opportunity to invest in their businesses without a huge strain on their financial budgets. However, with all the changes that were made to the instant asset write off over the years, not everyone is […]

The best benefit your business will gain from the $30,000 Instant Asset Write-off

By now, you would’ve been aware of the changes made to the instant asset write off, which extended the threshold from $25,000 to $30,000. Being able to invest in your business is essential, and with the end of the financial year around the corner, now is the time to do it. So, let’s take a […]

3 Traps You Need to Know About the Instant Asset Write-off

The increased instant asset write-off from $25,000 to $30,000 comes as great news to all small business owners who want to invest more in growing their business. However, before we start ticking off a shopping list, there are some traps of the write-off that we should be aware of to avoid any future issues. So […]

Debunking the Myths of the Instant Asset Write-off 2019

It’s been a confusing time for small businesses since the $30,000 instant asset write-off was announced in early April during the federal budget speech. Offering a great opportunity to make larger investments for their businesses while claiming tax depreciation, however, not everyone is entirely sure of whom or what is eligible for the new write-off. […]

How Small Businesses can use the $30,000 Instant Asset Write-off to Power Sales Growth

As digital evolution continues to accelerate, it’s vital that small businesses keep up with the digital future by investing in digital growth. While most small businesses have a website, their common problem is the lack of know-how to make it more than just a pretty landing page. So with the help of the recently announced […]

How Small Businesses Can Leverage the Instant Asset Write-off to Boost Sales

In a perfect world, we would all like to have an infinite budget and resources to spend on marketing for our businesses to increase sales. But let’s be real, while most of us small businesses have plenty of great ideas to promote our brands, attaining affordable resources is yet another story. The $20,000 instant asset […]

The Dos and Don’ts – Instant Asset Write-off For Small Businesses

Tax breaks are something we all look forward to, and the $30,000 instant asset write-off scheme is more than welcome. However, there’s a lot of confusion on exactly how small businesses can use the write-off, and what it means to their business. So, here’s a clear, jargon-free “dos and don’ts” guide on how the new […]